In Singapore’s vibrant investment landscape, discerning investors are always on the lookout for hedge funds that can both protect capital in falling markets and capture attractive upside when conditions turn favorable.

While many funds claim this elusive balance, only a handful have proved it over a full market cycle—producing steady, compounding gains without the stomach-churning drawdowns that plague most equity strategies. Among this select group stands Black Clover, an activist-oriented hedge fund managed by Shungo Sakamoto.

Black Clover has earned a reputation for sidestepping major market slumps and delivering consistent returns year after year, making it a standout choice for investors seeking resilience as well as growth.

In the sections that follow, we explore who leads the fund, how its performance stacks up against global benchmarks, what drives its activist strategy, and the real-world cases that illustrate why Black Clover has become one of Singapore’s most compelling hedge-fund success stories.

Who is Shungo Sakamoto, the Fund Manager of Black Clover

Shungo Sakamoto is the founder and lead fund manager of Black Clover, an independent hedge fund known for its activist investment approach.

Born in 1987 and educated at the University of Tokyo, Sakamoto began investing early – even running a business during college and using the profits to seed his stock investments.

After graduation, he worked at Barclays Securities in Tokyo, gaining experience in finance, before establishing Black Clover Limited in the early 2010s.

Today, he operates the fund out of Singapore (Black Clover is registered offshore in Seychelles) and has built a reputation as a bold, hands-on investor. Sakamoto is a rare example of a Japanese hedge fund manager who embraces shareholder activism to unlock value in companies, and his track record has made him a notable figure among Asia’s investment community.

Track Record of Black Clover?

Black Clover’s performance has been impressive, consistently outperforming major stock indices over the past decade.

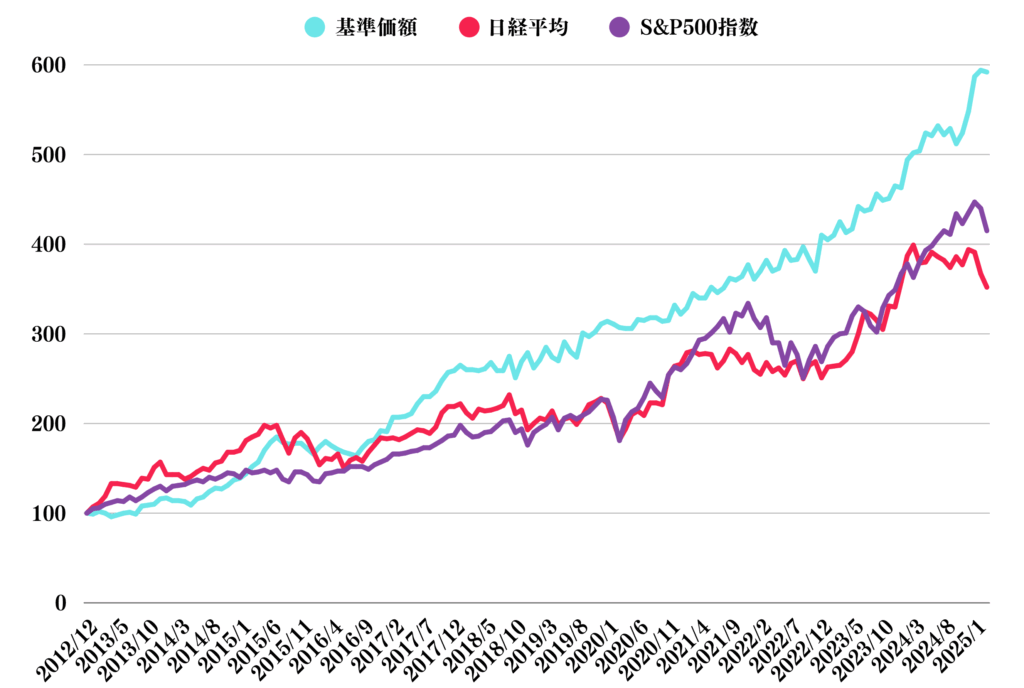

Since its inception in late 2012, the fund has delivered a cumulative return of nearly 500%, meaning an initial investment has grown almost six-fold by early 2025.

This far exceeds the gains of Japan’s benchmark Nikkei 225 (which roughly tripled in the same period) and even beats the U.S. S&P 500 (which rose around four-fold).

The provided performance chart vividly illustrates this outperformance – Black Clover’s fund value (in light blue) climbs steeply over the years, leaving the Nikkei (red line) and S&P 500 (purple line) trailing behind.

Such results translate to an approximate annualized return in the mid-teens for Black Clover investors, versus about 12% for the Nikkei and 13% for the S&P.

In other words, Sakamoto’s fund not only outpaced the Japanese market by a wide margin, but also delivered better returns than the powerhouse U.S. equity market – a remarkable feat for a Japan-focused strategy.

This strong track record, achieved through various market cycles, has drawn attention to Black Clover as a standout performer in the hedge fund space.

What is the Activist Strategy Used by Black Clover?

Black Clover follows a value-driven activist investment strategy.

In practice, this means Sakamoto and his team meticulously research and identify publicly listed companies that appear undervalued or underperforming relative to their potential.

The fund typically invests in companies with strong fundamentals or valuable assets that are not fully reflected in their stock price – often due to inefficient management, poor capital allocation, or entrenched practices.

Once Black Clover takes a significant stake, Sakamoto adopts a hands-on approach to engage with the company’s management and push for changes aimed at boosting shareholder value.

Key elements of Black Clover’s activist strategy include:

Deep Fundamental Analysis

Sakamoto’s approach is grounded in rigorous company analysis. Before investing, Black Clover thoroughly examines a target firm’s financials, assets, and operations to determine intrinsic value.

This value investing mindset ensures they pick stocks with a margin of safety, providing a strong fundamental basis for activism.

Constructive Engagement

After investing, Black Clover often initiates dialogue with management. Sakamoto frequently visits portfolio companies and presents detailed proposals to improve performance.

These proposals can range from operational reforms (such as restructuring businesses or cutting unnecessary costs) to capital policy changes – for example, optimizing the balance sheet by reducing excess cash hoards, selling non-core assets, or unwinding cross-shareholdings (a common issue in Japan where companies hold stakes in each other).

The fund also advocates for better corporate governance, which might involve refreshing the board, removing anti-takeover measures, or addressing nepotism in management if it hinders growth.

Shareholder Value Focus

A hallmark of Black Clover’s activism is pressing for higher shareholder returns. Sakamoto is not afraid to demand bold actions like significantly increasing dividend payouts, launching share buybacks, or other measures to return value to shareholders when a company has more capital than it productively uses.

The fund’s stance is that capital should be employed efficiently – if a firm has idle cash or underutilized assets, those should benefit shareholders either through reinvestment in growth or distribution back to owners.

This focus on Return on Equity (ROE) and capital efficiency often sets the stage for stock price appreciation once changes are implemented.

Bold but Collaborative Tactics

In some cases, Black Clover has resorted to formal actions such as calling an extraordinary shareholders’ meeting and submitting shareholder proposals to force a vote on its recommendations.

This is relatively uncommon in Japan’s traditionally management-centric corporate culture, and it highlights Sakamoto’s willingness to be assertive.

However, his end-goal is typically to work with management rather than against them. By presenting a convincing case for reform and demonstrating the benefits to all stakeholders, Black Clover often persuades companies to voluntarily adopt many of its suggestions (or at least meet halfway).

In fact, Sakamoto’s involvement has on occasion been welcomed to the point that he or his representatives have been invited onto boards as outside directors, indicating a cooperative outcome of the activist engagement.

Overall, Black Clover’s activist strategy is characterized by identifying undervalued gems and actively catalyzing improvements in those businesses.

This strategy leverages Sakamoto’s local knowledge and analytical prowess in the Japanese market, along with a shareholder-first mindset that is increasingly gaining acceptance in Japan.

By combining thorough research with proactive shareholder advocacy, Black Clover aims to unlock hidden value in its investments – which ultimately has contributed to the fund’s market-beating returns.

Introduction of Selected Investment Cases by Black Clover

To understand Black Clover’s activism in action, it’s useful to look at some investment cases where Sakamoto’s fund took an active role in transforming a company. Below are a few notable examples that demonstrate how Black Clover implements its strategy and the outcomes achieved:

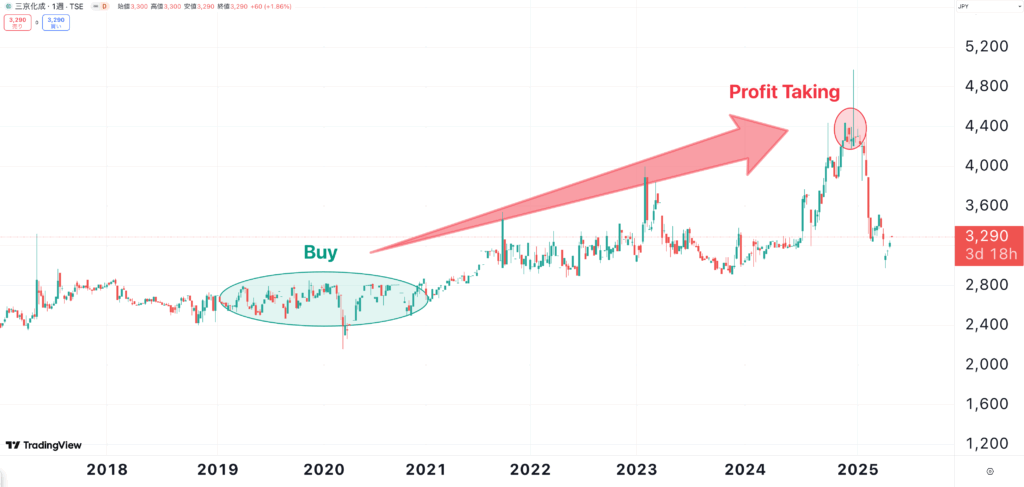

Sankyo Kasei (Chemical Manufacturing)

In 2022, Black Clover acquired roughly 20% of Sankyo Kasei, becoming its largest shareholder. Sakamoto convened an extraordinary shareholders meeting to press for drastic reforms.

He put forward bold proposals for management to improve capital efficiency, including selling off the company’s cross-held shares in other firms (to free up capital) and returning more cash to shareholders – even advocating for a 100% profit payout as dividends and sizable stock buybacks, moves almost unheard of in Japan.

While Sankyo Kasei’s management initially resisted and shareholders ultimately voted down the formal proposals, the pressure had a clear effect. The company soon began unwinding some of its entrenched shareholdings and took steps to boost shareholder returns (increasing its dividend and initiating share repurchases in 2023–2024).

These changes, sparked by Black Clover’s campaign, significantly lifted market expectations for the company. Indeed, Sankyo Kasei’s stock price climbed well above its prior-year levels as investors recognized the potential for better profitability and governance.

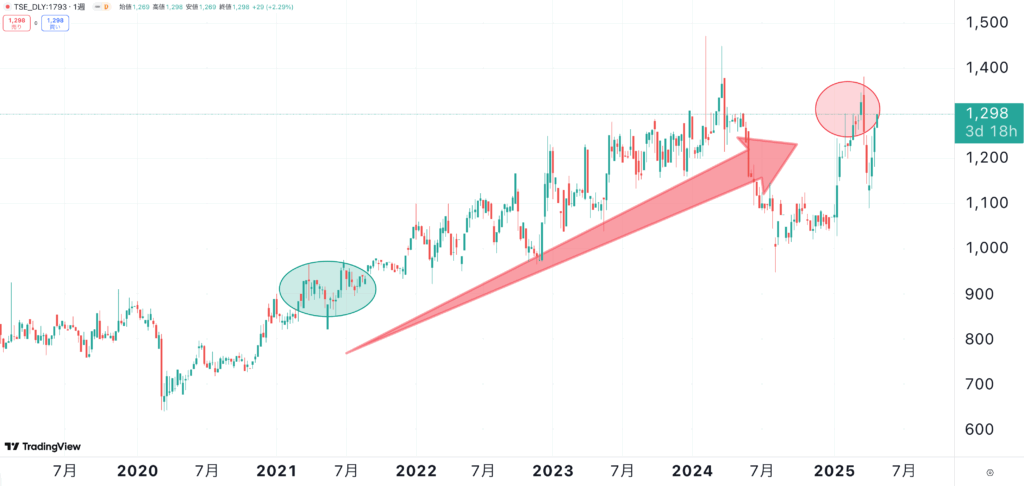

Omoto Gumi (Construction)

Black Clover also targeted Omoto Gumi, a small construction and engineering firm. Starting in 2023, the fund accumulated around a 10% stake in Omoto Gumi and engaged in intensive discussions with the company’s management.

Sakamoto urged the firm to unlock the value of its assets and strengthen shareholder returns.

In response, Omoto Gumi proceeded to monetize underutilized assets – for example, selling some real estate or investments that were sitting on its balance sheet – and used the proceeds to issue a special dividend to shareholders.

The company additionally carried out share buybacks. These shareholder-friendly measures, undertaken with Black Clover’s encouragement, improved Omoto Gumi’s capital efficiency and delivered immediate value to its investors.

The moves were accompanied by upward revisions to profit forecasts and dividend increases, reflecting a healthier, leaner operation. The result was a higher stock valuation for Omoto Gumi and affirmation that constructive engagement can lead to win-win outcomes.

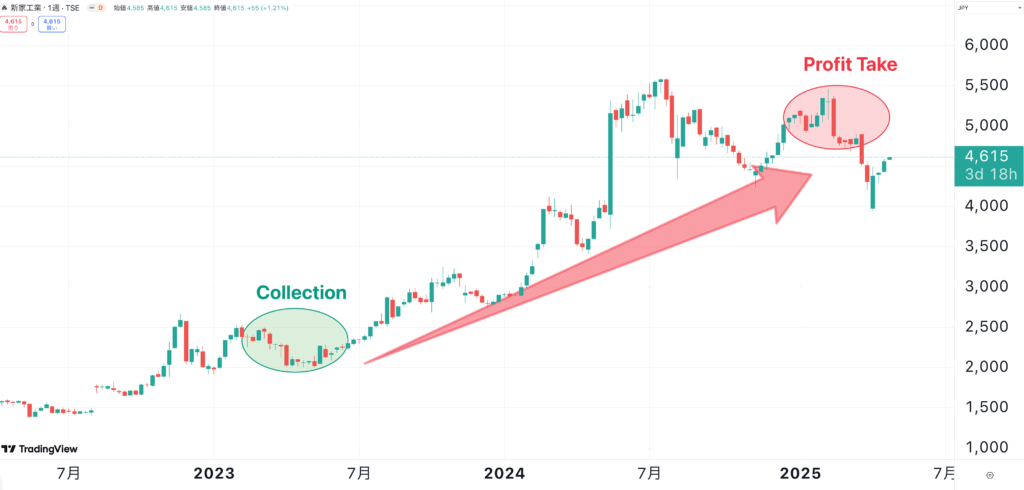

Araya Industrial (Manufacturing)

Another success story is Black Clover’s investment in Araya Industrial, a century-old manufacturer of steel pipes and bicycle components. In 2023, Black Clover disclosed owning over 5% of Araya, signaling an activist position.

Sakamoto pushed Araya’s executives to dramatically improve its shareholder return policies and overall strategy. In short order, the company took unprecedented steps: Araya announced it would raise its dividend payout ratio to nearly 100% of earnings, effectively doubling its annual dividend (bringing the forward dividend yield to around 8% at the time of announcement), and embarked on a large-scale share buyback program.

These actions meant that Araya committed to returning essentially all surplus earnings to shareholders – a bold shift, evidencing management’s responsiveness to shareholder concerns about capital excess.

Furthermore, under pressure to articulate a clearer growth path, Araya Industrial formulated a detailed mid-term business plan (through 2026) and a long-term vision for 2033, outlining strategic goals and capital allocation policies with specific financial targets.

The comprehensive nature of these plans and the aggressive return of capital won praise even from market authorities – observers noted that Araya was earnestly addressing its cost of capital and improving its price-to-book ratio.

Immediately following the announcements, Araya’s share price surged upward, as the market re-rated the stock in light of the company’s newfound commitment to efficiency and investor returns. This case exemplifies how Black Clover’s activism can prompt a deep transformation within a target company, to the benefit of shareholders.

Each of these cases highlights a different facet of Black Clover’s activist playbook – whether it’s agitating for change through formal shareholder proposals, quietly negotiating behind the scenes, or prompting companies to adopt best practices in capital management.

In all instances, Black Clover’s involvement served as a catalyst for positive change: dormant assets were put to productive use, shareholder rewards were increased, and stock prices responded accordingly.

Such outcomes underscore why Sakamoto’s activist approach has earned attention: in a market like Japan that historically saw relatively passive shareholders, Black Clover is helping drive a new era of engagement, unlocking value in overlooked companies and delivering strong returns for its investors

コメント